Will cryptocurrency revolutionise the global economic system? Or will its ideology be its undoing?

I download the Telegram app on to my iphone reluctantly. I don’t want another message app, least of all one I’d heard the ‘alt-right’ now favour. But I’d been told this is where I will learn about Cryptocurrency and begin the journey to making my fortune. My arm is twisted. I join the two groups recommended to me and as I scroll through past messages, confusing jargon and incomprehensible ‘tips’, I feel overwhelmed. Is this really the future?

I remember a time when Bitcoin was a cooky idea for tech nerds and now I’m seeing it everywhere. My local real estate agent accepts it as payment, recently the country of El Salvador was the first in the world to make it legal tender and I have friends who are (apparently) on track to make millions with cryptocurrency.

Enthusiasts claim the new technology will change the world, and Bitcoin, or something like it, will emerge as the new decentralised global currency. We will be free of banks and governments and the people will finally be in control. A revolution. Twelve years after they came on the scene, cryptocurrencies are still essentially a speculative investment, but the gains can be huge. With 70 per cent of the world’s central banks now using similar technology to develop their own versions of digital currency, it looks like there might be something to this.

Is the nature of money as we know it about to change? Will our children be spending nothing but Bitcoin? Are we missing out on a future of untold wealth if we don’t jump in now? Or is this all just an ideological farce? I took a deep breath and dived into the world of ‘crypto’ to see what I could find out.

Cryptocurrencies are digital forms of peer-to-peer currency that use blockchain technology and cryptography to circumnavigate the need for a middleman, or trusted party, such as the bank. The blockchain is the ‘digital ledger’ that is shared across a global network of computers, which all verify and store every transaction of the currency. The transactions are secured using a complex system of codes, known as cryptography, and every transaction is visible and available to everyone else on the network. The blockchain, not the bank, is the ‘proof’ that a transaction is legitimate.

Although attempts at peer-to-peer currencies have been made before, Bitcoin was the first to be fully developed by the mysterious Satoshi Nakamoto, who posted a paper outlining his invention on a cryptography mailing list in 2008. The coin began to be exchanged and ‘mined’ but had no value until, in 2010, an early enthusiast bought two pizzas for 10,000 bitcoins. Today, one bitcoin is worth around $54K AUD, so I hope, for their sake, that whoever sold him those pizzas hung on to the proceeds.

From 2011 onwards, as the popularity of bitcoin and the principles behind it grew, other cryptocurrencies began to emerge, collectively known as ‘Alt Coins’. Each Alt Coin builds on the initial blockchain technology in the aim of improving and developing new uses for it. There are now thousands of them and trading on crypto exchanges like a futuristic stock market has become an obsession for many.

I have a headache just trying to understand the basics. I open one of the recommended Telegram groups, Crypto Queens, for inspiration.

“Anyone else staking Theta to earn Tfuel? Just bought myself some Theta with the dip.’” Reads the first message I see.

I close the group. I’m not sure I’m up for this.

It was Chen Ling who advised me to download Telegram, as we chatted while she waited outside her daughter’s dance class. I had met Ling once, 8 years earlier, through a mutual friend when she was based in Sydney. At the time she was house-sitting for free rent; now she has an ‘exit plan’ of half a million dollars by this November. “Seriously, you have to get into this,” she told me. “The gains are just insane.”

Chen moved to the small beach town of Agnes Waters in 2017, at the Southern end of the Great Barrier Reef in Queensland. She and her husband had planned to retire there but decided to make the move earlier for their children’s schooling at a Waldorf Steiner centre. Coincidentally, her new town made the news in 2018 for being one of the first in Australia to widely accept cryptocurrencies as a form of payment.

“It’s just so exciting to be part of the future,” she said, the sounds of children laughing and shouting in the background. “It’s literally the next evolution of the internet.”

Ling’s enthusiasm bounces between her words as she explains her journey. It was May 2020, the height of the Covid 19 pandemic, and Ling, who is a wellness practitioner, had been following alternative media news on YouTube. “There were all these conspiracy theories going around,” she said, and although she believed in them to some extent, she found it all too depressing. “I needed something else to focus my energy on.”

Then her favourite channel hosted a section on Bitcoin. “I was like, holy shit, why did I not even look into this?” She laughed. “So that’s how I started. And since then, I never looked back.”

Ling emphasises that investing in Crypto is not just about coins and currency, but about the technology behind it. Each coin or token is based on a different form of blockchain technology that solves a particular real-world ‘problem’. To explain she provides an example: one coin is designed to use the blockchain ‘ledger’ to authorise luxury goods such as handbags, differentiating them from counterfeits. The blockchain would hold the information on where and when the bag was manufactured, authorised by the brand, as well as any former owners. These are the kind of real-world solutions Ling insists are the future.

“That’s cryptocurrency,” she says. “It’s not just buying a coin and trying to make money from it; it’s participating in a technology that is going to change the way we do things.”

It was de-centralisation though, the core ideology of cryptocurrencies, that first attracted her. The very nature of de-centralisation means there is no central governing body of any cryptocurrency; everyone who invests is theoretically able to have some control. “You have an opportunity to be part of the governance,” Ling said, “and that’s what’s important.”

She was particularly sold on the idea that blockchain technology could create de-centralised media platforms, where ‘free speech’ could prevail. She expressed her frustration at Facebook and YouTube being able to moderate and ban users if they “don’t like what you post”.

“Imagine if you could jump across and just say well, if you use this piece of tech, it’s not owned by anyone, no one can censor you really,” she said. “Imagine the potential of that!”

Given the torrent of misinformation currently being shared and consumed, the ‘potential of that’ is terrifying. Crypto appears to appeal not just to tech enthusiasts or those looking to make a tidy profit, but also those with libertarian views of distrust in government and individual freedom and sovereignty. This thought was further strengthened when a number of the ‘crypto queens’ began sharing shockingly inaccurate videos and anti-vax conspiracies about the Covid 19 vaccination.

Ling was also afraid the economic policies to ease the burden of Covid lockdowns were not sustainable. “Our current system is not working. Everyone’s printing money now so inflation’s going to go through the roof.”

Ironically, it was these government supplements that Ling used to kick-start her investment journey. She managed to stockpile the unexpected family benefits, and adding $30,000 of the proceeds of the sale of her house in the same year, she started with a $40,000 initial investment. Seven months later, through a complex system of investing and trading in various ‘coins’, she claims to have around a quarter of a million dollars.

Astounded, I asked her when she would ‘cash out’ – sell her crypto gains for Aussie dollars.

“My personal target is 1 million, but 500,000 would be where my safety net is – that would be my first cash out. That’s my exit plan,” she told me. “I have a good chance. Fingers crossed!”

After our conversation I dug a little deeper into this new world and was sucked into a rabbit hole of YouTube videos for longer than I would have liked. Despite the cult-like vibe, I was starting to get my head around the technical aspects of the coins. But one thing that I remained confused about was this: Did wealth in ‘Crypto’ actually translate to wealth in the real world? After all, the roughly $240,000 that Ling claimed she had was sitting in a ‘digital wallet’ in denominations of 25 different cryptocurrencies, not in dollars that could be spent. Ling explained she periodically sells off a large chunk of her gains and spends it over a few months using a crypto debit card, created in partnership with Visa. Most investors though, prefer not to spend their coins, which would impact on their investment strategy.

When it does come time to execute the ‘exit plan’, there are myriad ways it could go wrong. Cryptocurrencies are notoriously susceptible to hacking, and as there is no central entity, no one can help you if you lose it. Crypto exchanges can crash and everything within them disappear. According to one YouTube video, you can send your coins to the ‘wrong address’ and lose everything in one click, whatever that means. Even if one of these computer-game-like obstacles don’t trip you up, the ATO would slap you with a capital gains tax of 50 per cent on exchange or cash out of any coins held for less than a year.

But enthusiasts have confidence. The belief is that the technology will continue to improve until all of the early wrinkles are ironed out and Bitcoin will triumphantly emerge as the world currency for the internet generation. This would presumably make the early investors like Ling and the ‘crypto queens’ among the richest people in the world, and those of us that let it pass by, mere plebs. Freedom indeed.

Regardless of whether Bitcoin would become an actual currency, there is little doubt that its arrival has paved the way for the development of Central Bank Digital Currencies, or CBDCs. These are essentially a digital version of a nation’s existing currency, using similar blockchain technology, that are issued and controlled by central banks. Unlike de-centralised cryptocurrencies, all transactions would be visible to the government and linked to the holder’s digital identity. Some say their existence could even do away with the need for commercial banks, since all transactions could be controlled by the issuing entity – the state. They are the antithesis of de-centralisation and raise concerns over further citizen surveillance by governments, especially in countries like China, currently first in the arms race with the forthcoming ‘digital Yuan.’

“One of the most fundamental fears of the government is them losing not just the ability to tax, but the ability to shape and influence the economy,” says futurist Ross Dawson, who also has a background in financial markets. “And that’s why there is this shift towards CBDCs.”

It seems the Bitcoiners have ruffled some feathers.

As well as CBDCs being a way for nations to claw back control of the economy, the first nation to develop the most viable and widely used CBDC could challenge the US dollar as the dominant global currency. The blockchain technology allows for much faster and cheaper transactions, something very important in large-scale international trade.

“This actually is an instrument of political influence by China,” says Dawson, who believes it’s possible for the use of the digital Yuan for trade to become dominant in some countries. “That changes the whole geo-political structure of the world. These are some quite fundamental battles.”

He does envision some scenarios in which de-centralised cryptocurrency such as bitcoin could become dominant, but believes it is highly unlikely. For Dawson, the future of money is less drastic.

“Currency is becoming digital,” he said, “both in terms of government mandated ones and those outside government systems. We have crudely three categories of money and all three of them exist now.” He is referring to ‘fiat currencies’ (the national currencies we currently use), cryptocurrencies and CBDCs. “One of the biggest questions of all is, what will be the balance between those in the future?”

Not wanting to miss out in case cryptocurrencies do fulfil their prophecies, I follow another piece of Ling’s advice and sign up for one of the most trusted crypto exchanges, crypto.com. I download another app and am prompted to scan my driver’s licence with my phone and take a selfie for my ID. It feels distinctly uncomfortable and, thanks to a crackdown from the ATO on crypto exchanges, a world away from the imagined freedom-based Utopia. I have to wait three days for verification. I’m relieved I don’t have to start my journey to riches just yet.

Malcolm Edey, a former senior executive of the Reserve Bank of Australia, would no doubt be pleased I wasn’t able to immediately commit my hard-earned money to such a cause. “I’ve always been sceptical about whether it’s got any long-term future,” he said, believing the lack of stable value to be the principal issue.

“The thing that gives an official currency a stable value is that it’s got a legal and institutional structure that’s all geared towards managing it,” says Edey. “Think of that as the role of the reserve banks.

“Nobody is managing bitcoin – bitcoin is managed by a computer program. The people that created it have an ideology that they don’t want anyone to manage it, they want a free market. But that will never create a stable value for bitcoin.”

As I muse on the ideology of bitcoin, I wonder how revolutionary it is after all. What I saw on YouTube and Twitter and Telegram, were people chasing individual monetary wealth. Whether this was tied to the government or not, where is the novelty in that?

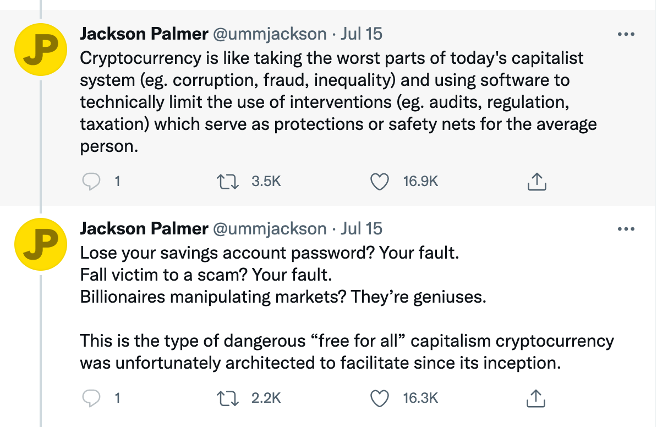

Jackson Palmer, the co-creator of Dogecoin, heavily criticised cryptocurrency in a recent ‘Twitterstorm’, labelling it ‘hyper-capitalistic’ and financially exploitative to the average investor. Dogecoin made headlines earlier this year when it saw an astronomical rise in value, due in part to public support from Elon Musk; precisely the kind of market manipulation that Palmer criticises. He claims the crypto market is controlled by a few very wealthy individuals who manipulate the market for their own benefit, with the advantage of facing zero regulations to impede them.

Known as ‘whales’ in the crypto world, around 40 per cent of the entire crypto market rests in the hands of 1000 or so individuals, who are capable of moving the markets with a single trade. According to one of Palmer’s tweets: “Despite claims of ‘decentralisation’, the cryptocurrency industry is controlled by a powerful cartel of wealthy figures who, with time, have evolved to incorporate many of the same institutions tied to the existing centralised financial system they supposedly set out to replace.”

Known as ‘whales’ in the crypto world, around 40 per cent of the entire crypto market rests in the hands of 1000 or so individuals, who are capable of moving the markets with a single trade. According to one of Palmer’s tweets: “Despite claims of ‘decentralisation’, the cryptocurrency industry is controlled by a powerful cartel of wealthy figures who, with time, have evolved to incorporate many of the same institutions tied to the existing centralised financial system they supposedly set out to replace.”

A criticism of die-hard crypto fans is the blind support of the technology, regardless of potential real-world consequences. The crypto twittersphere was delighted when El Salvador made Bitcoin a national currency, regardless of the fact an authoritarian leader was essentially making it illegal to not accept a currency that could plummet in value the next day. As long as bitcoin was winning, that’s all that seemed to matter. “Bitcoin to the moon!” as they say.

I emerge from my exploration of cryptocurrency as confused as when I entered. The only thing I am sure of is that nobody is sure about the future of money. Should cryptocurrency even be seen as ‘money’? Since it is rarely used as an actual currency, it might be closer to an alternative, deregulated, technology-based stock market. Of those who believe digital currencies are the future, some see it as a battle between the dystopia of government surveillance of CBDCs and the Utopian freedom of de-centralisation. Others see the inherent instability in value of de-centralised cryptocurrency as its inevitable downfall. Perhaps we’ll fall somewhere in-between.

Although I stopped short of becoming a ‘Crypto Queen’, I am aware things won’t remain the same for long. “If the very nature of money is to be transformed, it’s very likely to be in this decade,” says Ross Dawson. “This decade is going to be the single most interesting one in the transition of money.”